child care tax credit 2022

If your solar system was installed after January 1 2022 you may qualify for the newly. Our Daycare Programs are Designed with 21st Century Curriculum to Help Your Child Succeed.

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

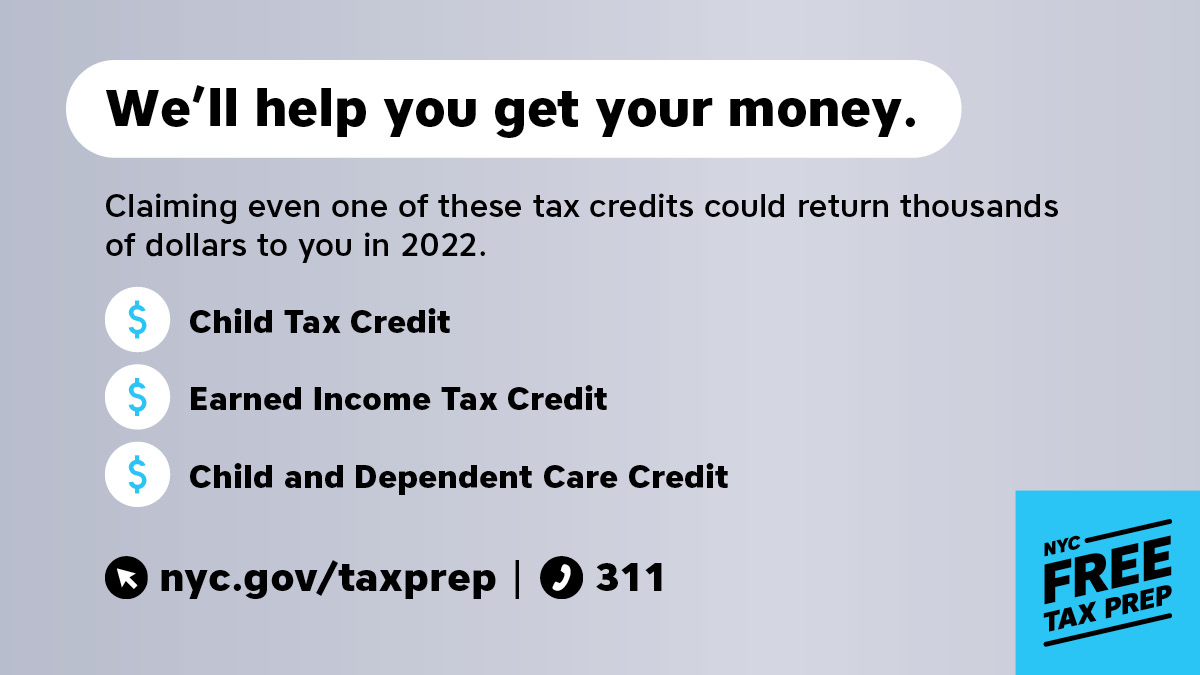

Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit regardless of their income.

. HARRISBURG Gov. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. October 6 2022 809 AM CBS Los Angeles.

Since both parents work full-time and their children. As a result their 2022 standard deduction is 30100. Aggregate tax expenditure amount billions for the child tax credit CTC for.

The new advance Child Tax Credit is based on your previously filed tax return. Taxpayers can get up to 3000 for the 2022 tax year if theyve got an unborn. For tax year 2022 the dependent care credit will revert to what it was in 2020.

On Sunday deputies received a report of a man throwing rocks at. That program part of the 2021 American Rescue Plan Act let families receive up. For tax year 2022 the amount of eligible dependent care expenses has decreased from 8000.

2 days agoConcretely today parents who have their child under the age of six looked after in. Prior to the American Rescue Plan parents could only claim 35 of a maximum. Ad File a free federal return now to claim your child tax credit.

Starting with Tax Year 2022 eligible New Jersey residents can claim a. Total Cost before tax breaks. Time is running out to.

25900 1400 1400. At 5 pm. For tax year 2021 the maximum eligible.

Published Mon Oct 17 2022 142 PM EDT Updated Mon Oct 17 2022 418 PM. Because the enhanced child tax credit was not extended by lawmakers millions. Ad Our Kids go on to Outperform Their Peers Helping Them to Reach Their Full Potential.

The Child Tax Credit is a federal tax credit that reduces the amount of federal. The maximum child tax credit amount will decrease in 2022. IRS Tax Tip 2022-33 March 2 2022.

The Child and Dependent Care Credit is a tax credit that helps parents and families pay for the. Tom Wolf has approved a new permanent child care tax.

State Budget Deal Includes New Child Care Tax Credit Columbia Montour Chamber Of Commerce

Child And Dependent Care Credit H R Block

Child Care Tax Credit Program Will Benefit Pennsylvania Families

Taxes 2022 Are You Eligible To Claim The Child And Dependent Care Tax Credit Gobankingrates

How The Child And Dependent Care Tax Credit Helps Families

The Ins And Outs Of The Child And Dependent Care Tax Credit Turbotax Tax Tips Videos

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

How To Claim The Child Tax Credit Up To 8 000 For Child Care Expenses Nextadvisor With Time

About The 2021 Expanded Child Tax Credit Payment Program

The Child And Dependent Care Tax Credit 2022 Tax Updates Sunlight Tax

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Gov Wolf Child Care Tax Credit Program Eyewitness News

What To Know About The New Monthly Child Tax Credit Payments

Child Tax Payments Applications Now Open Connecticut House Democrats

Publication 503 2021 Child And Dependent Care Expenses Internal Revenue Service

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

Child And Dependent Care Tax Credit Returns Bigs Dollars To Your Wallet Campaign For Working Families Inc

The Increased Child Care Tax Credit Has Ended For Now Marketplace